Mass Timber and Duration Risk in Long-Cycle Development

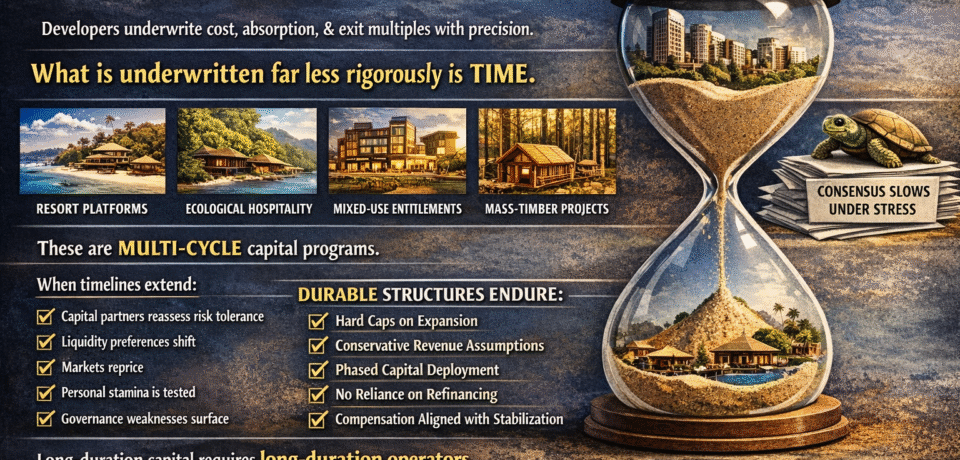

Why Material Strategy Is Really a Time Strategy Mass timber is usually framed as a sustainability decision. That framing is incomplete. In long-horizon real estate, the dominant variable is not embodied carbon or aesthetic warmth. It is time. And when evaluated through the lens of long-cycle development risk management, mass…