Long-Cycle Development Risk Management: Engineering for Duration

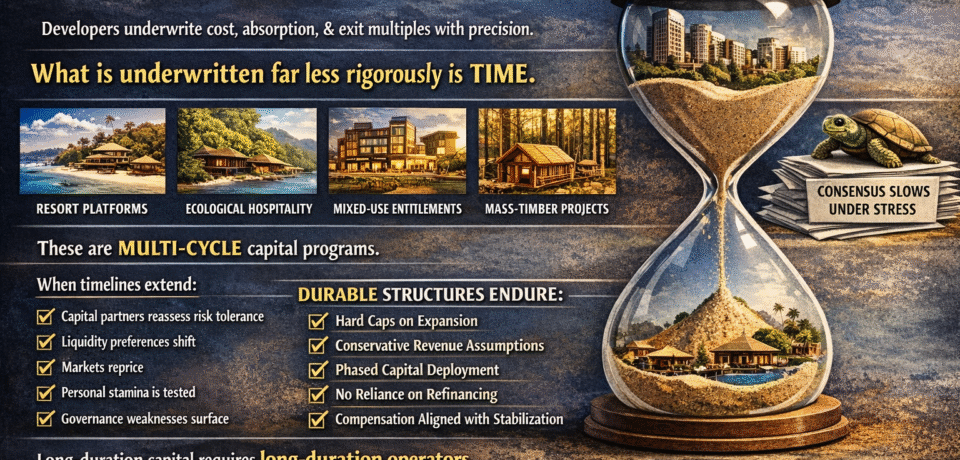

Why Duration, Not Volatility, Defines Real Estate Outcomes Most real estate risk frameworks are built around volatility. They focus on cap rates.They stress interest rate shocks.They model exit sensitivity. But in long-cycle development, the dominant variable is not price movement. It is time. When timelines extend, capital structures weaken, governance…