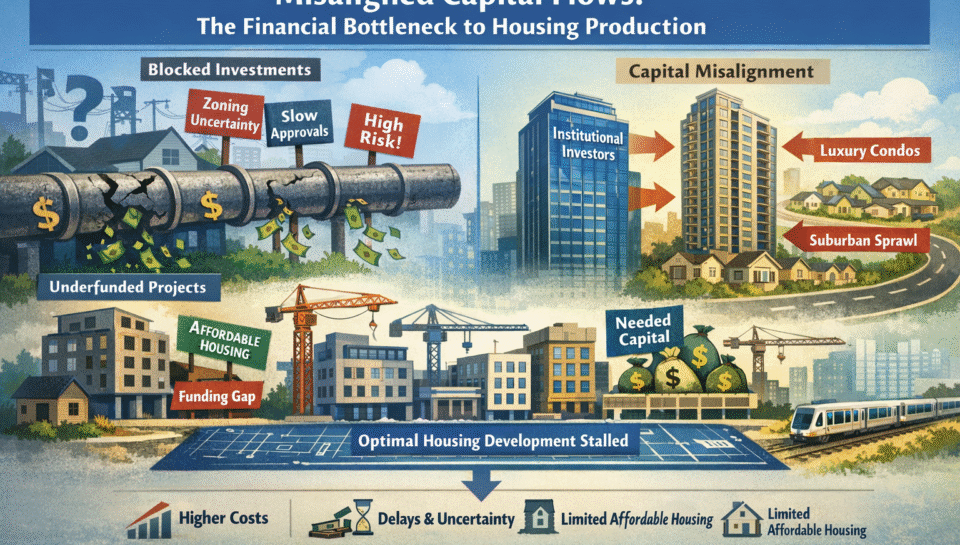

As outlined by Tyson Dirksen in The Housing Shortage Is a Systems Failure — Here’s the Framework to Fix It, effectively addressing the U.S. housing shortage requires tackling systemic failures across zoning, delivery mechanisms, capital flows, construction productivity, and underutilized housing stock. Even with permissive zoning and streamlined approval processes, housing production cannot scale without capital flowing efficiently into the right projects. Misaligned capital flows compound supply constraints, undermining both market-rate and affordable housing outcomes.

The Nature of Misaligned Capital

Housing development requires multiple types of capital: land acquisition, predevelopment (design, permitting, environmental review), construction, and post-construction financing. While capital is abundant in the financial system, allocation often avoids projects perceived as high-risk due to:

-

Zoning Uncertainty: Even by-right zoning may be underutilized if investors perceive political or regulatory instability.

-

Discretionary Approval Processes: Sequential approvals and subjective design reviews increase timelines and risk premiums.

-

Market Complexity: Missing-middle and mid-rise developments often fall below the radar of institutional investors, who favor large-scale, high-density projects with predictable cash flows.

This misalignment results in structural underfunding: scalable, high-demand housing types like 4–8 story mid-rise buildings and transit-oriented 8–12 story projects receive insufficient investment, while low-risk, low-yield projects dominate portfolios.

Quantifying the Impact

Empirical evidence demonstrates that misaligned capital flows significantly affect housing production:

-

Higher Financing Costs: Projects with uncertain entitlements face interest rates 1–3% higher than low-risk investments, adding 10–15% to total development costs over multi-year timelines.

-

Delayed Capital Deployment: Capital often remains idle in markets with unpredictable regulations. Projects requiring discretionary approvals see 25–50% slower deployment than by-right developments.

-

Reduced Institutional Participation: Large-scale investors often avoid smaller, complex projects due to perceived risk and illiquidity.

Predictability as a Lever to Unlock Capital

Capital allocation responds directly to certainty and risk mitigation. Predictable zoning and delivery processes increase housing investment:

-

By-Right Zoning: Converts potential density into investable assets, lowering the cost of capital.

-

Streamlined Delivery Mechanisms: Parallel and ministerial approval processes reduce timelines and carrying costs.

-

Transparent Design Standards: Objective, consistent criteria reduce ambiguity and increase investor confidence.

Cities adopting by-right mid-rise zoning with predictable delivery can see capital deployment for multi-family housing increase 20–35% over five years, attracting institutional investors to previously overlooked projects.

Case Studies in Capital Realignment

-

Vienna, Austria: Predictable zoning and parallel approvals, combined with clear financing pathways, enabled public and private capital to efficiently scale mid-rise, transit-oriented developments.

-

Portland, Oregon: TOD-focused 8–12 story developments attracted institutional investors after by-right approvals reduced entitlement risk.

-

California Pilot Programs: Predictable ADU and multi-family permitting resulted in a 20–25% increase in production, largely driven by improved financing availability.

These examples demonstrate that aligning capital flows with zoning and delivery reforms multiplies the system-wide potential for housing production.

Systemic Implications: Capital as a Multiplier

Capital is the circulatory system of housing production. Misaligned flows constrain both the number and type of units built. Capital interacts with the other systemic levers:

-

Restrictive Zoning: Unlocks investable assets for mid-rise and TOD development.

-

Inefficient Delivery Mechanisms: Predictable approvals reduce risk premiums, lowering financing costs.

-

Low Construction Productivity: Stable funding enables the adoption of prefab, modular, and industrialized methods.

-

Underutilization of Existing Stock: Financial viability of infill and retrofits improves when capital is aligned.

-

Affordable Housing Outcomes: Lower financing costs and predictable cash flows allow inclusion of more affordable units without subsidies.

Without aligned capital flows, even optimal zoning and delivery reforms fail to translate into scalable housing production.

Policy Recommendations

-

Expand By-Right Zoning and Ministerial Approvals: Reduce entitlement risk and enable institutional capital participation in mid-rise and TOD projects.

-

Create Targeted Housing Investment Funds: Pool public, philanthropic, and institutional capital to support missing-middle and affordable housing.

-

Guarantee or Insure Entitlement Risk: Reduce investor exposure to discretionary approvals and appeals.

-

Promote Standardized Build Envelopes: Facilitate industrialized construction to reduce unit costs and improve ROI.

-

Integrate Capital Planning into Transit-Oriented Development: Align high-capacity transit corridors with scalable investment strategies.

Implementing these recommendations enables cities to turn regulatory and procedural reforms into actual housing units, reinforcing systemic improvements across all five levers.

Conclusion

Zoning reform and streamlined delivery mechanisms set the stage, but capital alignment drives housing production. Misaligned flows inflate costs, delay projects, and reduce investor participation. By aligning capital with predictable, by-right projects, cities can convert potential density into actual units. Housing scarcity is a systems failure; only by integrating zoning, delivery, and capital can scalable, affordable, and resilient housing outcomes be achieved.